Our Process

The Problems That We Address

The problems we address are lack of access to affordable financial services by the rural poor, missing last-mile service delivery, distance and lack of transport, transaction failures, frauds, grievance redressal, lack of relationship with banks etc.

WHO WE SERVE?

Population Under-Served By Traditional banking Channels

Rural low income,less educated groups such as farmers, women, artisans, blue-collar workers

Urban low-income population predominantly migrant workers, living in urban outskirts having rural characteristics

People wanting better banking services such as flexi loan products, ease of doing business and technology supported services

Our Universe

Total Universe 70 million rural poor and rural credit gap of approx. 17.8 lakh crore

Target Universe

10 million rural poor of Haryana , Punjab, U.P, Uttarakhand.

Strategy to serve

Formation of 100000 Self Help Groups in a period of 7 years. Train, link them to formal financial services, establish an exclusive poor bank to serve them

Key Performance Indicators

- Number of Self Help Groups

- Loan Outstanding

- Total NPA

Market Landscape of served/Unserved clients

| Types Of Entity | No. Of Entities | Unique Borrowers (Cr) | Active Loan Accounts(Cr) | Active Loan Accounts(Cr) |

|---|---|---|---|---|

| NBFC-MFIS | 84 | 2.53 | 3.63 | 69933 |

| Banks | 12 | 2.6 | 3.72 | 94355 |

| SFB | 8 | 1.47 | 2.03 | 43142 |

| NBFC | 46 | 0.86 | 0.97 | 22060 |

| Others | 21 | 0.11 | 0.14 | 2289 |

| Total | 171 | 5.71 | 10.5 | 231778 |

Source: MFIN Website Accessed on 17-03-2021

* Total Rural Market Estimated at Rs. 20 Lakh Crore of which only 11.5% as above is served.

Serving The Underserved – Market Landscape

CHALLENGES OF UNDERSERVED

~70K rural bank branches for 650K villages .Only 11% of the rural credit demand of approximately 20 lakh crores is met through formal and informal channels. Unviable for traditional channels due to low-ticket transactions.

Low penetration of financial products such as insurance (3.71%), savings and pension plan; massive credit gap (30% of lending is informal credit/money-lenders)

Remoteness of villages and lack of transportation, poor digital connectivity, inadequate staff and poor response to problems highlighted by the poor, etc.

Poorly-educated; fear using technology, need handholding.

OPPORTUNITIES FOR US

Our competitors are Informal money lenders, MFIs, NBFC-MFIs, Regional Rural Banks, Cooperatives. We will be competing for the same audience but who are at present unserved or underserved. We offer decentralized door step banking through non brick and mortar model. We work on the principle of aggregation of demand through Self Help Groups to reduce cost of transaction, generate vast local employment, and adopt state of art fintech technology for giving effective services to the poor.

Mainstream institutions and Government of India are also relying on private fintech players for low-cost delivery to last-mile.

We go a step further by offering credit plus services such as livelihood support, social security, and quality of life improvement services.

Our USP is our partner SKDRDP BC Trust, Dharmasthala who are leaders in Self Help Group movement. They are invested in us both by way of equity and by way of process and technology sharing.

OPPORTUNITIES FOR US

Enabling eco-system set -up by GOI

Massive digital push by GOI

Growing rural outlay $38Bn. in FY’21

2x growth in farmer income by FY’22 by GOI

525 Mn. rural mobile users

Our Unique Solution

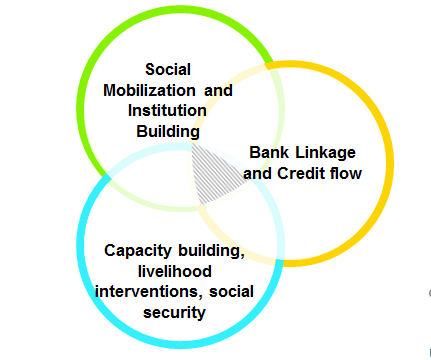

Social Mobilization & Institution Building

- Mobilize poor into Self Help Groups(SHG), build saving culture, link them to formal financial institutions, offer life long support for sustainability

- Aggregation of products and services for integrated delivery

- Payment platforms – Biometric, Cards, tablets

Bank Linkage and Credit

- Link SHGs to formal institutions, offer need based flexi credit option

- Grade SHGs and build their credit history, make them bankable as individual customers

Capacity Building

- Skilling, Training and livelihood interventions, Poverty proofing against unexpected

Products / Solutions Offerings and outcomes

| Banking and Digital Payments | Digital account opening, deposits, withdrawals | Door step delivery of banking services for the poor |

| Financial and Allied Services | Insurance, pension and saving plans | Social security for the poor |

| New Age Solutions | Pre-paid cards UPI, QR-code Merchant payments Loan repayments | Rapid adoption of technology by rural India leading to higher productivity |

| Micro-Credit To Self Help Groups | Flexi Loan products, weekly deposits, weekly repayments, small affordable repayment installments Micro Insurance products | Make poor bankable by creating their credit history, local employment generation, empowerment |

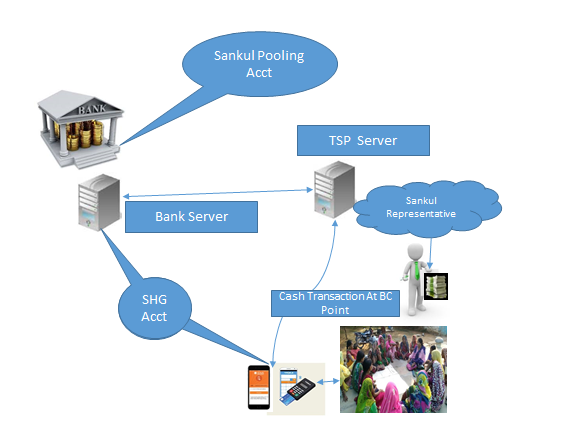

Pictorial replica of the transactions

- Withdrawal or Deposit of the Cash takes place at the specified place through Sankul representative. The Authorised representative of the members of the Group undertake transaction.

- Cash Credit Limit is set by Sankul based on group quality and is pre loaded in the system

- The transactions are made through the Chip enabled card with biometric authentication.

- Once a transaction is made through the hand held machine and chip enabled card the transactions is captured at the server of TSP (Dr/Cr).

- The above debit or credit is than routed to Sankul server at HO.

- Such Transactions are reflected in the pooling account of Sankul maintained at bank Branch and respective SHG Account at bank Branch.